September 11, 2025

Regarding the Network for Greening the Financial System’s (NGFS) Issues with New Climate Damage Function – An Open Letter to the Office of the Superintendent of Financial Services

See CC list in the PDF version

ATTN: Peter Routledge, Superintendent

Dear Superintendent Routledge,

A recent report by climate policy analyst Roger Pielke, Jr., reveals that the 2024 selection of the “climate damage” function by the Network for Greening the Financial System, drawn from the paper by Kotz et al (2024), is deeply flawed and not fit for purpose. A subsequent report by Jessica Weinkle finds that the Kotz et al paper appears to have significant conflicts of interest as well. On Aug. 22, 2025, NGFS posted a note that the users of NGFS scenarios bear the responsibility for use of the NGFS scenarios.

The reports referred to in this letter can be found at this link: https://www.ngfs.net/en/publications-and-statistics/publications/ngfs-climate-scenarios-central-banks-and-supervisors-phase-v

The use or misuse of climate damage functions will have significant socio-economic impacts on society, especially if stemming from the banking/finance sector which, in turn, affects all aspects of modern life. As per Neumann et al (2020) “Climate damage functions are also the basis of the modeling (e.g., Nordhaus 2010; Anthoff and Tol 2013; Hope 2013) that supports estimates of the social cost of carbon (National Academies of Sciences, Engineering, and Medicine 2017).”[1]

Thus, the carbon tax price is founded in climate damage functions. A wildly exaggerated climate damage function will result in a wildly exaggerated price on carbon – or carbon tax – that is not warranted.

As you are aware, in Canada, the reduction of the consumer-facing carbon tax from its high point of $80/ tonne CO2e to zero, as enacted by incoming Prime Minister Mark Carney,[2] had an almost immediate benefit of reduction in costs across the Canadian economy.[3] Inflation dropped 1.7% and, “As the divisive carbon tax ended, gasoline prices took a nosedive, dropping 18.1 per cent in April compared to a year earlier. Natural gas prices fell 14.1 per cent during the same period, StatsCan noted.” These are significant reductions in costs for Canadians, who live in the second largest country in the world, challenged by vast distances to travel for work, the necessity of access to reliable, affordable energy to heat homes and businesses in times of extreme cold, and the unfortunate fact that most of our food is imported and transported to and fro by train and truck. As Prof. Sylvain Charlebois (The Food Professor) and colleagues ascertained, food prices are directly and indirectly affected by the carbon tax, largely related to transportation costs.[4] In Charlebois’ work, he indicates that carbon pricing did reduce greenhouse gas emissions. However, we note that coincident to that time of rising carbon prices, there was a rapid rise in bankruptcies in Canada, in part, due to COVID lockdowns, in part due to inflation; no one has parsed out to what extent the “emissions reduction” was due to bankruptcy and which due to the carbon tax burden.

Thus, we return to the issue of the NGFS choice of Kotz et al (2024) as the ‘climate damage function’ for modelling climate risk.

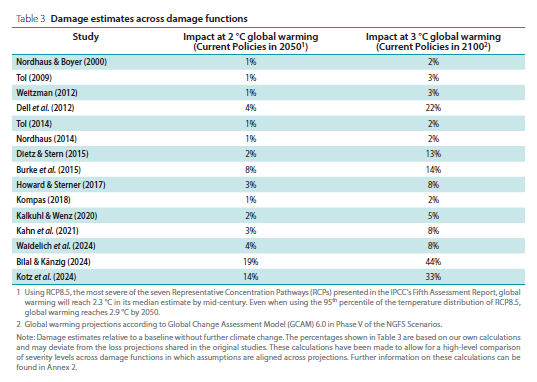

The table above of damage estimates across damage function, shows the astounding leap in impact, that should have been a clue that the Kotz et al formula was flawed. Indeed, Pielke, Jr. reports that within weeks of publication of Kotz et al (2024) there were statements of concern made known to the publisher, Nature. Also note in the footnotes of the table above, that the implausible scenario Representative Concentration Pathway RCP 8.5 is referenced, when this has been known to be an outlier for several years now. We have written you letters about the misuse of this scenario in the past.

By contrast, the recent climate science report issued by the US Department of Energy, “A Critical Review of Impacts of Greenhouse Gas Emissions on the U.S. Climate” holds a far more nuanced view of the impact of carbon dioxide on the economy.

Continue reading the letter in the PDF version below.

Leave a Reply! Please be courteous and respectful; profanity will not be tolerated.